Highlighting the best of the Compound ecosystem. For more updates, join the Compound community on Discord, Twitter, LinkedIn and Comp.xyz.

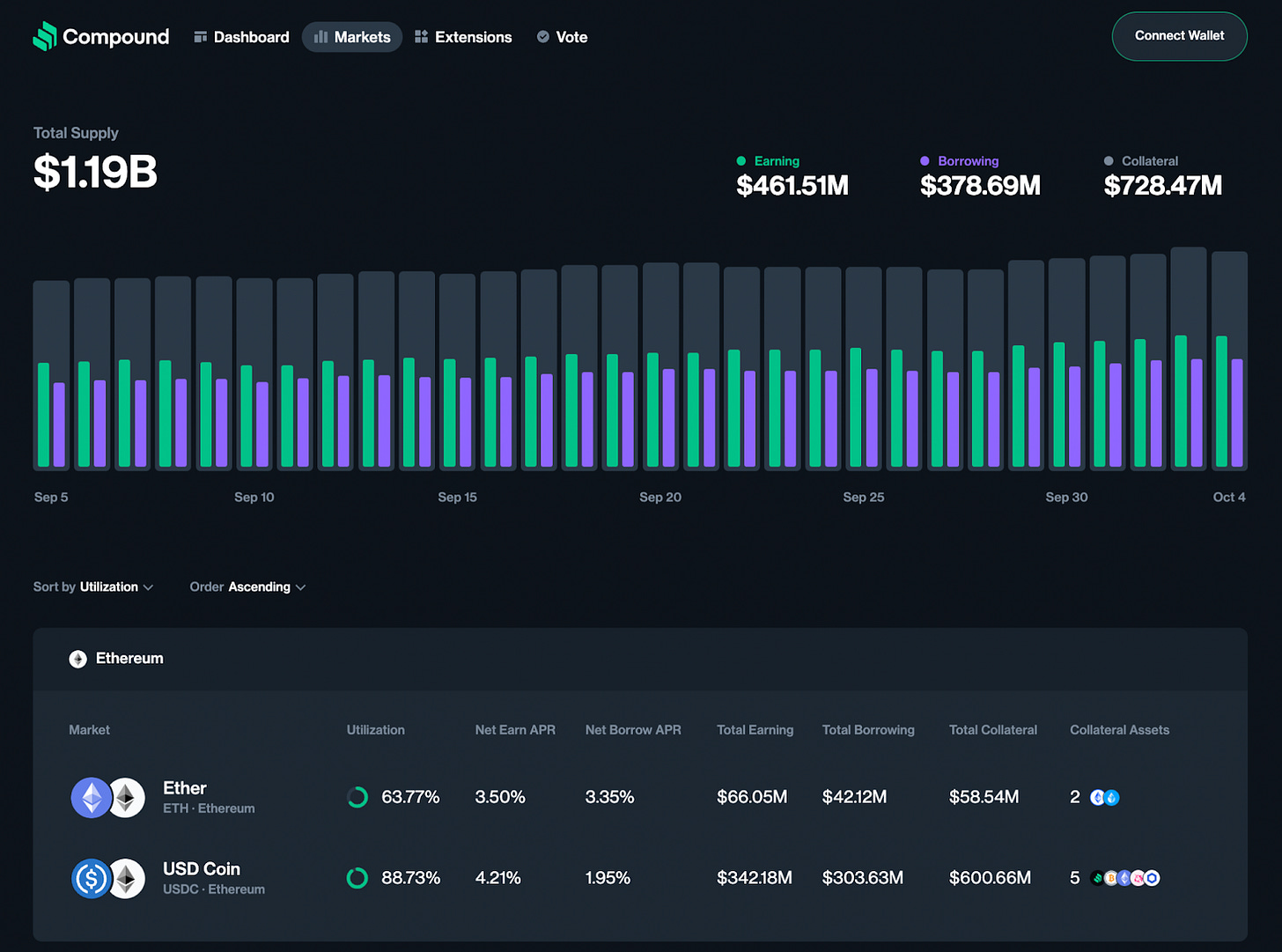

Compound III flips Compound v2

Last week, Compound III surpassed Compound v2 in both total assets and borrowing.

Since launching last August, Compound III has grown to over 1.7B in total assets and 500M in borrowing, across 7 markets on 4 networks.

View the markets here.

Base WETH market vulnerability patched, no funds at risk

The community discovered and patched a vulnerability in the Base WETH market - no funds were affected or at risk.

The vulnerability would have been highly unprofitable to exploit, requiring 5000-10000x in gas costs for an attacker to withdraw funds directly from the Base WETH market ($5-10+ billion in gas to steal $1 million). Due to the siloed design of Compound III, no other markets were affected.

The vulnerability is disclosed in the forums here.

Aera Pilot Update

The Aera pilot diversified $500K of reserves from Compound v2 ($400K in ZRX and $100K in BAT), launched at the end of October after passing governance.

The vault is currently valued at ~$750K, up from an initial allocation of $500K - this is mostly due to a run up in price from ZRX.

View the vault dashboard here, and follow ongoing updates in the forum post.

Protocol Governance Updates

Highlighted governance proposals summarized below. View all of the latest governance proposals at https://compound.finance/governance/proposals.

Proposal 201 - [Gauntlet] 2023-12-04: Ethereum v3 WETH Interest Rate Curve Recommendations

Status: Executed December 11, 2023

Proposer: Gauntlet

Voting Results: 560,439 For and 0 Against

Summary: A proposal from Gauntlet to adjust five Interest Rate (IR) Curve parameters in the Ethereum v3 WETH comet:

Decrease Annual Borrow Interest Rate Base from 0.0099 to 0.005

Decrease Annual Borrow Interest Rate Slope Low from 0.037 to 0.03

Increase Annual Borrow Interest Rate Slope High from 0.5172 to 1.0

Decrease Annual Supply Interest Rate Slope Low from 0.0284 to 0.023

Increase Annual Supply Interest Rate Slope High from 0.6067 to 1.0

For more details, see the full forum post here.

Proposal 200 - [Gauntlet] 2023-12-04: Compound v2 Deprecation (Phase 5)

Status: Executed December 11, 2023

Proposer: Gauntlet

Voting Results: 614,233 For and 0 Against

Summary: A proposal from Gauntlet to adjust 7 Compound v2 risk parameters for Phase 4 of the Compound v2 Deprecation.:

Decrease cAAVE Collateral Factor from 58% to 53%

Decrease cCOMP Collateral Factor from 45% to 40%

Decrease cLINK Collateral Factor from 64% to 59%

Decrease cMKR Collateral Factor from 58% to 53%

Decrease cSUSHI Collateral Factor from 52% to 47%

Decrease cYFI Collateral Factor from 60% to 55%

Decrease cZRX Collateral Factor from 50% to 45%

Decrease cWBTC2 Borrow Cap to 250

For more details, see the full forum post here.

Proposal 199 - Compound Growth Program

Status: Executed December 10, 2023

Proposer: PGov (for Alpha Growth)

Voting Results: 630,443 For and 0 Against

Summary: AlphaGrowth proposes a Compound Growth Program dedicated to advancing the Compound Protocol through targeted Business Development, Integration, and Marketing Campaigns. The program is structured with a total budget of 7770 COMP, distributed over a 4-month period and allocated into two distinct funds: BD Fund and Growth Fund. The forum post for the proposal can be found here.

Proposal 198 - OpenZeppelin Security Partnership - 2024 Q1 Compensation

Status: Executed December 7, 2023

Proposer: OpenZeppelin

Voting Results: 510,804 For and 0 Against

Summary: We receive our quarterly payments in a lump-sum of COMP. Based on the last week's volume-weighted average price, this would be $52.01 per COMP for a total quarterly payment of 19,229 COMP equaling $1M per the original agreement. This COMP will be transferred from the Comptroller using _grantComp. More detail in this forum post.

Proposal 197 - [Gauntlet] 2023-11-27: Arbitrum Native USDC - Risk Recommendations

Status: Executed December 4, 2023

Proposer: Gauntlet

Voting Results: 560,849 For and 0 Against

Summary: A proposal from Gauntlet to adjust two risk parameters in the Arbitrum Native USDC comet:

Increase ARB Supply Cap from 4M tokens ($4.10M) to 8M tokens ($8.20M)

Increase WBTC Supply Cap from 600 tokens ($22.30M) to 1,200 tokens ($44.60M)

For more details, see the full forum post here.

Proposal 195 - [Gauntlet] 2023-11-20: Base v3 WETH Interest Rate Curve Recommendations

Status: Executed November 27, 2023

Proposer: Gauntlet

Voting Results: 437,092 For and 0 Against

Summary: A proposal from Gauntlet to adjust five Interest Rate (IR) Curve parameters and one risk parameter in the Base WETH comet:

Decrease Annual Borrow Interest Rate Base from 0.0099 to 0.005

Decrease Annual Borrow Interest Rate Slope Low from 0.037 to 0.035

Increase Annual Borrow Interest Rate Slope High from 0.5172 to 1.0

Decrease Annual Supply Interest Rate Slope Low from 0.0284 to 0.025

Increase Annual Supply Interest Rate Slope High from 0.6067 to 1.0

Gauntlet recommends the following risk parameter update:

Increase baseBorrowMin from 1e-18 to 1e-6

For more details, see the full forum post here.

Proposal 194 - Top-up COMP Rewards on Compound V3 mainnet contract

Status: Executed November 20, 2023

Proposer: Gauntlet

Voting Results: 564,601 For and 0 Against

Summary: COMP rewards ran out on the Compound III mainnet CometRewards contract, resulting in users being unable to claim their COMP rewards. Gauntlet proposes to transfer 100,000 COMP (corresponding to roughly 150 days of distribution) from the Comptroller to the Rewards contract for Compound III on the mainnet.

Proposal 193 - [Gauntlet] 2023-11-13: Compound v2 Deprecation (Phase 4)

Status: Executed November 20, 2023

Proposer: Gauntlet

Voting Results: 614,601 For and 0 Against

Summary: A proposal from Gauntlet to adjust 7 Compound v2 risk parameters for Phase 4 of the Compound v2 Deprecation.:

Decrease AAVE Collateral Factor from 63% to 58%

Decrease COMP Collateral Factor from 50% to 45%

Decrease LINK Collateral Factor from 69% to 64%

Decrease MKR Collateral Factor from 63% to 58%

Decrease SUSHI Collateral Factor from 57% to 52%

Decrease YFI Collateral Factor from 65% to 60%

Decrease ZRX Collateral Factor from 55% to 50%

For more details, see the full forum post here.

Proposal 192 - Add rETH as Collateral to wETHv3 Mainnet

Status: Executed November 17, 2023

Proposer: Michigan Blockchain

Voting Results: 730,861 For and 5,208 Against

Summary: See proposal and parameter recommendations here.

Proposal 190 - [Gauntlet] 2023-10-30: Compound v2 Deprecation (Phase 3)

Status: Executed November 7, 2023

Proposer: Gauntlet

Voting Results: 564,609 For and 0 Against

Summary: A proposal from Gauntlet to adjust 7 Compound v2 risk parameters for Phase 3 of the Compound v2 Deprecation:

Decrease AAVE Collateral Factor from 68% to 63%

Decrease COMP Collateral Factor from 55% to 50%

Decrease LINK Collateral Factor from 74% to 69%

Decrease MKR Collateral Factor from 68% to 63%

Decrease SUSHI Collateral Factor from 62% to 57%

Decrease YFI Collateral Factor from 70% to 65%

Decrease ZRX Collateral Factor from 60% to 55%

For more details, see the full forum post here.

Proposal 189 - CGP 2.0 Updates and Renewal

Status: Executed November 5, 2023

Proposer: Michigan Blockchain

Voting Results: 610,457 For and 21,285 Against

Summary: Based on the impact and insights derived from CGP 2.0, we propose renewing CGP 2.0 with a budget of $970k for two quarters. The domain allocators will utilize this budget to fund proposals that align with Compound's roadmap. Domains:

Dapps and Protocol Ideas - $450K

Multi - Chain/Cross chain Strategy, Dev Tooling - $200K

Security Tooling - $150K

Detailed information related to CGP 2.0’s funding breakdown, relevant metrics, insights, and proposed improvements going forward can be found here.

Proposal 188 - [Gauntlet] Arbitrum v3 USDC Native - Risk Recommendations (2023-10-16)

Status: Executed October 23, 2023

Proposer: Gauntlet

Voting Results: 484,014 For and 0 Against

Summary: A proposal from Gauntlet to adjust one risk parameter in the Arbitrum v3 USDC Native comet: Increase WBTC supply cap from 300 tokens to 600 tokens. For more details, see the full forum post here.

Proposal 187 - Aera Pilot Proposal

Status: Executed October 23, 2023

Proposer: Gauntlet

Voting Results: 484,013 For and 0 Against

Summary: A proposal from Aera to initiate a free $500k pilot to diversify out of ZRX and BAT reserves (from Compound V2 ETH) and then hold the proceeds in a Volatility targeted portfolio. For more details, see the full forum post here.

Ongoing Discussions

See all the latest discussions on the Compound Community Forum. Click here for a recap of our most recent Developer Community Call, discussing ongoing protocol and application development.