Compound Liquidator bot developer guide; stMATIC on USDC • Polygon; New Markets overview

Highlighting the best of the Compound ecosystem. For more updates, join the Compound community on Discord, Twitter, LinkedIn and Comp.xyz.

Compound Liquidator Bot Tutorial

Learn how to build a liquidator bot on the Compound protocol with Adam Bavosa, Developer Relations Lead at Compound Labs. Powered by Alchemy, Autocode, and Sendgrid, the liquidator bot actively monitors positions and executes liquidations, with real-time email alerts.

Watch the tutorial on Alchemy University’s YouTube channel:

stMATIC added as collateral on the USDC • Polygon market

Lido staked MATIC (stMATIC) has been added as a collateral asset on the USDC • Polygon market.

View the USDC • Polygon market.

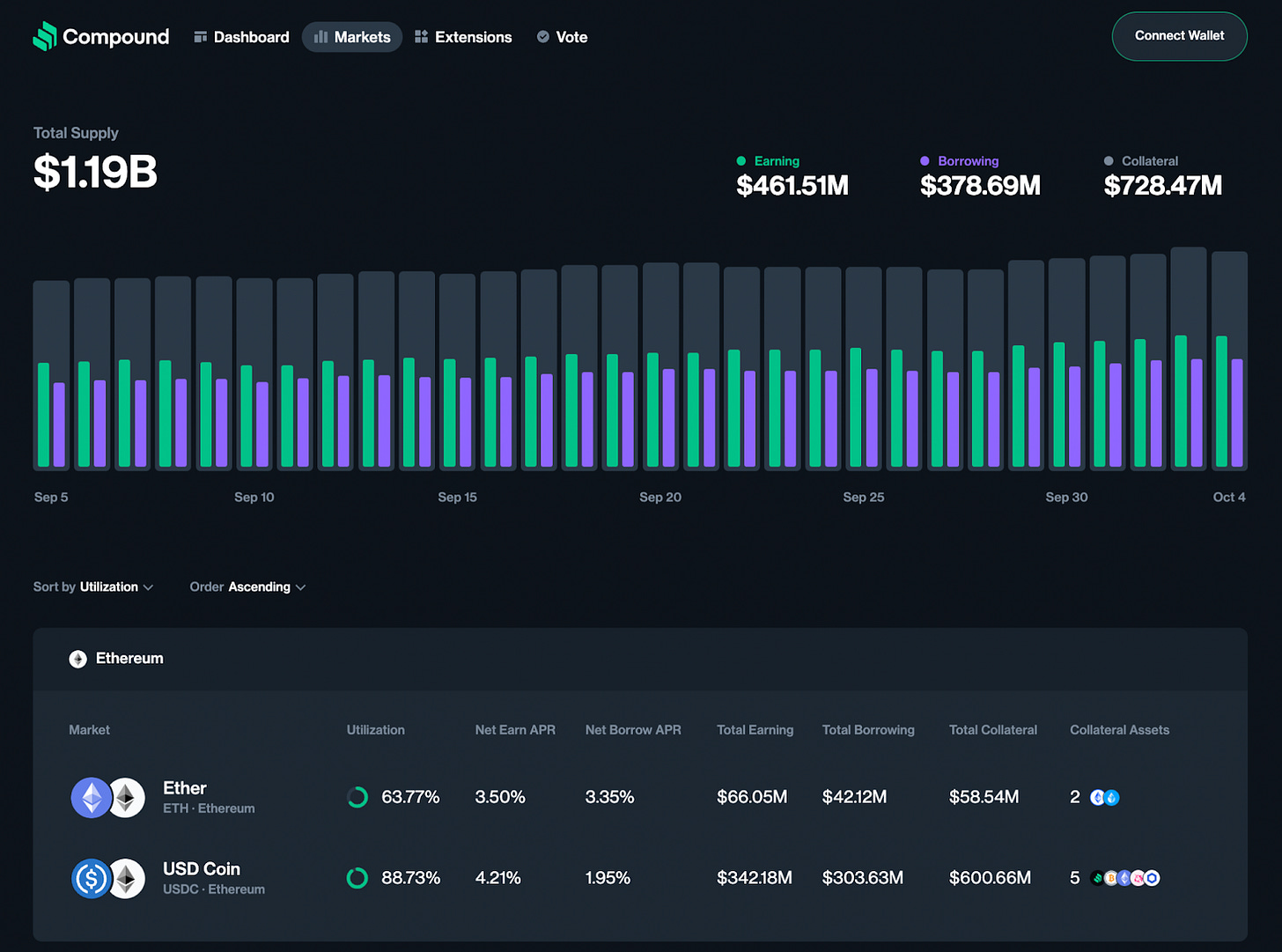

New Markets overview page

The Markets page now displays all Compound III markets on one page, letting users more easily navigate Compound. Markets are grouped by network, with each market’s primary data arranged on a single row, and can be sorted by Earn or Borrow APR, or Totals.

See the new Markets overview page at https://app.compound.finance/markets/

Compound V2 market data can be accessed here.

Protocol Governance Updates

Proposal 186 - [Gauntlet] 2023-10-09: Compound v2 Deprecation (Phase 2)

Status: Queued October 14, 2023

Proposer: Gauntlet

Voting Results: 709,157 For and 0 Against

Summary: A proposal from Gauntlet to adjust 8 Compound v2 risk parameters for Phase 2 of the Compound v2 Deprecation:

Decrease cAAVE Collateral Factor from 73% to 68%

Decrease cCOMP Collateral Factor from 60% to 55%

Decrease cLINK Collateral Factor from 79% to 74%

Decrease cMKR Collateral Factor from 73% to 68%

Decrease cSUSHI Collateral Factor from 67% to 62%

Decrease cYFI Collateral Factor from 75% to 70%

Decrease cZRX Collateral Factor from 65% to 60%

Increase v2 USDC Reserve Factor from 30% to 45%.

For more details, see the full forum post here.

Proposal 185 - OpenZeppelin Security Partnership - 2023 Q4 Compensation

Status: Executed September 29, 2023

Proposer: OpenZeppelin

Voting Results: 865,101 For and 0 Against

Summary: We receive our quarterly payments in a lump-sum of COMP. Based on the last week's average price, this would be $39.76 per COMP for a total quarterly payment of 25,148 COMP equaling $1M per the original agreement. More details in this forum post.

Proposal 184 - Add stMATIC as Collateral to USDCv3 Polygon Market

Status: Executed October 5, 2023

Proposer: Penn Blockchain

Voting Results: 734,587 For and 0 Against

Summary: This proposal is to set the parameters for stMATIC as below based on Gauntlet's recommendations:

supplyCap: 8,000,000

borrowCollateralFactor: 60%

liquidateCollateralFactor: 65%

liquidationFactor: 7%

Proposal 182 - [Gauntlet] Arbitrum v3 USDC Reward Recommendations (2023-09-18)

Status: Executed September 28, 2023

Proposer: Gauntlet

Voting Results: 678,169 For and 0 Against

Summary: A proposal from Gauntlet to adjust two COMP reward distributions in the Arbitrum USDC native comet:

Increase Daily COMP USDC Supply Rewards from 10 to 20.

Increase Daily COMP USDC Borrow Rewards from 0 to 20.

For more details, see the full forum post.

Proposal 181 - Gauntlet <> Compound Renewal 2023

Status: Executed September 25, 2023

Proposer: Gauntlet

Voting Results: 673,172 For and 0 Against

Summary: A proposal to renew Gauntlet’s 12-month engagement with Compound on continuous market risk management to maximize capital efficiency while minimizing the risk of insolvency and liquidations to create long-term sustainable growth. Gauntlet renewed its partnership with Compound last year in September, which runs through September 27, 2023. The service fee structure will be a fixed annual fee of $2,000,000, completely in COMP tokens.

For more details, see the full proposal.

Proposal 180 - [Gauntlet] 2023-09-11: Compound v2 Deprecation (Phase 1)

Status: Executed September 18, 2023

Proposer: Gauntlet

Voting Results: 658,176 For and 0 Against

Summary: A proposal from Gauntlet to adjust 8 risk parameters, distribution rewards, and IR curve parameters across the v2 and Ethereum v3 USDC protocols for Phase 1 of the Compound v2 Deprecation:

Increase v2 USDC Reserve Factor from 15% to 30%.

Decrease v2 USDC daily COMP supply distribution from 66.20 to 0.

Decrease v2 USDC daily COMP borrow distribution from 91.20 to 0.

Increase Ethereum v3 USDC COMP supply distribution from 100 to 257.40.

Decrease Ethereum v3 USDC Supply Kink from 95% to 93%.

Decrease Ethereum v3 USDC Borrow Kink from 95% to 93%.

Increase Ethereum v3 USDC Annual Supply Interest Rate Slope High from 0.76 to 1.5.

Increase Ethereum v3 USDC Annual Borrow Interest Rate Slope High from 0.567 to 1.5.

For more details, see the full forum post here.

Ongoing Discussions

See all the latest discussions on the Compound Community Forum - highlighted proposals below. Click here for a recap of our most recent Developer Community Call, discussing ongoing protocol and application development.

Proposer: harsha (Questbook)

Summary: Based on the impact and insights derived from CGP 2.0, we propose renewing CGP 2.0 with a budget of $970k for two quarters. The domain allocators will utilize this budget to fund proposals that align with Compound’s roadmap. After researching, and gathering feedback from domain allocators, active community members, and builders, we propose supporting the following domains:

Dapps and Protocol Ideas ($450K)

Security Tooling ($150K)

Aera Pilot for Compound v2 Reserves

Proposer: Aera (Gauntlet)

Summary: The proposal does the following:

Accepts ownership of the vault, asset registry, and hooks module.

Removes ZRX and BAT from V2 reserves.

Specifically, ~$400k of ZRX and ~$100k of BAT. This ratio was chosen due to onchain liquidity conditions.

Deposits into the Compound Aera vault.

Resumes the Aera vault to allow for rebalancing to take place by the vault guardian.

This is a non-custodial vault, meaning the Compound Governor Bravo Timelock owns the vault. Thus, the DAO can initiate withdraw/deposit requests via a governance proposal at any time.

Gauntlet will serve as the vault guardian for this vault. There are no fees associated with this pilot.