Compound launches on Arbitrum; Transaction History now available in-app

Highlighting the best of the Compound ecosystem. For more updates, join the Compound community on Discord, Twitter, LinkedIn and Comp.xyz.

Compound III is live on Arbitrum

The Compound III USDC market is live on Arbitrum! This marks the third chain Compound is deployed on - bringing the security and efficiency of Compound III to more ecosystems.

At launch, ARB, GMX, WETH, and WBTC can be used as collateral to borrow USDC.

View the new market by selecting Arbitrum from the market selector in the Compound interface, or by clicking the link here: https://app.compound.finance/?market=usdc-arb

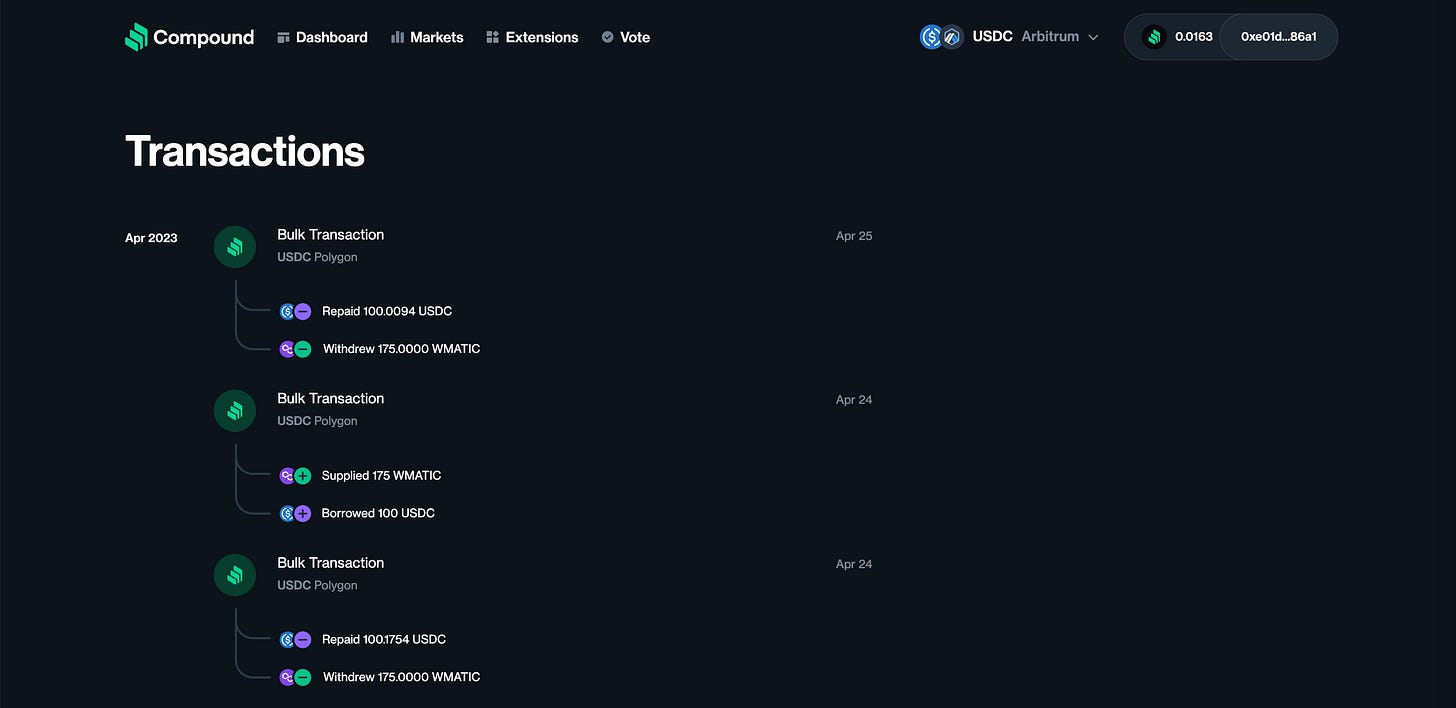

Transaction History now available in the Compound App

Transaction History is now available in the Compound interface - users can easily view all their transactions on Compound III in one place.

To access Transaction History, go to https://app.compound.finance/transactions, or click the wallet address in the top right corner of the Compound interface, and click “See All” next to Recent Transactions.

Unpacking the US regulatory environment for crypto with Polygon

Our guest is Rebecca Rettig, Chief Policy Officer at Polygon Labs. On this episode of Compound Thesis, we unpack the flurry of events in crypto legislation and regulation, implications for builders in the crypto space, and how Polygon is navigating these developments:

1. Why the US is taking a drastically different regulatory approach compared to rest of the world, and its implications

2. Real-world use cases already deployed by major brands and organizations on Polygon

3. The path forward to regulating tech-driven financial innovations

Watch the full episode, or listen and subscribe to Compound Thesis on YouTube, Spotify, or Apple Podcast.

Protocol Governance Updates

Proposal 161 - Risk Parameter Updates for Polygon Compound v3 USDC (5/9/23)

Status: Executed May 18, 2023

Proposer: Gauntlet

Voting Results: 549,917 For and 0 Against

Summary: A proposal from Gauntlet to adjust the supply cap for 3 assets in the Polygon | USDC market, and adjusting the COMP distribution in the same market.

Increase daily USDC supply COMP distribution from 0 to 34.73 ($1,268/day)

Increase WBTC supply cap from 400 ($12M) to 1,000 ($30M)

Increase WETH supply cap from 11k ($22M) to 20k ($40M)

Increase MATIC supply cap from 10M ($10M) to 20M ($20M)

For more details, see the full forum post here.

Proposal 160 - Initialize cUSDCv3 on Arbitrum

Status: Executed May 15, 2023

Proposer: Compound Labs

Voting Results: 490,143 For and 0 Against

Summary: This proposal takes the governance steps recommended and necessary to deploy the Arbitrum | USDC market on Compound III. Simulations have confirmed the market's readiness, as much as possible, using the Comet scenario suite. Further detailed information can be found on the corresponding proposal pull request and forum discussion.

Proposal 159 - Refresh Polygon COMP

Status: Executed May 7, 2023

Proposer: Compound Labs

Voting Results: 490,291 For and 0 Against

Summary: Since the launch of the Compound III Polygon | USDC market a month ago, the market has grown steadily and is operating as expected. The initial seeding of COMP distribution only provisioned enough for a few months, as a conservative starting point. This proposal bridges an additional 12,500 COMP to sustain the current distribution speeds of the market for an additional year (approximately). More discussions can be found on this forum thread.

Proposal 157 - OpenZeppelin Security Partnership - 2023 Q2 Compensation

Status: Executed April 7, 2023

Proposer: OpenZeppelin

Voting Results: 462,555 For and 0 Against

Summary: OpenZeppelin receives quarterly payments in a lump-sum of COMP for their auditing and security support for Compound III, this proposal was to initiate the next quarterly payment to OpenZeppelin. Based on last week's average price, this would be $42.34 per COMP for a total quarterly payment of 23,617 COMP equaling $1M per the original agreement. This COMP will be transferred from the Timelock's existing balance. More detail in this forum post.

Proposal 156 - Compound V2 -> V3 Migration (Phase 2)

Status: Executed April 5, 2023

Proposer: Gauntlet

Voting Results: 945,605 For and 0 Against

Summary: Following community feedback, please see the below Phase 2 plan to align with the community's strategic preference. See the forum post for more detail.

Decrease v2 daily USDC supply COMP distribution from 211.20 to 161.20 (-50)

Decrease v2 daily USDC borrow COMP distribution from 211.20 to 161.20 (-50)

Decrease v2 daily DAI supply COMP distribution from 211.20 to 161.20 (-50)

Decrease v2 daily DAI borrow COMP distribution from 211.20 to 161.20 (-50)

Increase v3 daily USDC borrow COMP distribution from 281.41 to 481.41 (+200)

Ongoing Discussions

See all the latest discussions on the Compound Community Forum - highlighted proposals below.

Proposer: Kyros

Summary: This discussion is about adding stMATIC as a collateral asset in the Polygon | USDC market on Compound III. The stMATIC token is a Lido-created asset allowing for the usage of staked Polygon as collateral in Defi protocols.

Liquidity Report - stMATIC currently has a TVL of 90M$ and total liquidity of 40M$ on ecosystem dexes with Balancer being the lead along with KyberSwap and QuickSwap having the most volume.

Kyros Proposed a Collateral Factor of 50%, a Liquidation Threshold of 65%, and a Liquidation Penalty of 10% for stMATIC.

As a reminder, one of the best ways to participate in, and contribute to the Compound ecosystem is completing outstanding Request For Proposals (RFPs)

Click here for a recap of our most recent Developer Community Call, discussing ongoing protocol and application development, and listen to the audio recording here.