Zapper Integration, Hiding Vault Launch, MKR, AAVE, SUSHI, YFI Listing Proposals

Compound Digest - July 30, 2021

Highlighting the best of the Compound ecosystem. For more updates, join the Compound community on Discord, Twitter, and Comp.xyz.

Earn Interest on Compound Through Zapper

Zapper, an all-in-one platform to manage, track, and invest in crypto, integrated the Compound protocol into its new save feature. While Zapper users could previously only track the value of their existing Compound positions, users can now supply any of the assets that the protocol supports to earn the prevailing interest rate. More details about the save feature are available in this help article.

Protect Against Liquidations with Hiding Vault

The KeeperDAO team recently announced the launch of Hiding Vaults, which provides borrowers with a new method to protect their positions from liquidation. Hiding Vaults are powered by a Just-In-Time-Underwriter (JITU) that adds additional collateral to at-risk borrowing positions, shielding them from the open ecosystem of liquidators. Borrowers can then add additional collateral or wait until the health of their position improves before borrowing further or withdrawing.

Hiding Vaults initially supports Compound, and will soon allow users to access multiple protocols from the same vault. Users will also receive ROOK, the governance token of the KeeperDAO ecosystem, as a reward for borrowing on the platform. There are currently $124m of assets being protected in 141 vaults, and should help onboard more users into DeFi borrowing.

Governance Updates

Since the last newsletter, Proposals 53 and 54 are in the active voting stage.

Completed Votes

Status: Active - 1 day, 6 hrs left

Proposer: MonetSupply

Voting Results: 305,624 For and 0 Against

Summary: Proposal 53 adds MKR as the next supported asset on Compound. The proposed market would feature a 0% collateral factor, 25% reserve factor, JumpRateModelV2 interest rate model and a 25,000 MKR borrow cap to mitigate the risk of governance attacks. The proposal was originally created by Getty Hill and Eddy Lee and was submitted by MonetSupply. You can read more about the proposed market on the accompanying forum thread.

Proposal 54: Add AAVE, SUSHI, YFI

Status: Active - 2 days, 8 hrs left

Proposer: Polychain Capital

Voting Results: 224,858 For and 0 Against

Summary: Following up on Proposal 53, Proposal 54 adds AAVE, SUSHI, and YFI as supported assets on Compound. Each of these markets will feature a 25% reserve factor, 0% collateral factor, and JumpRateModelV2 interest rate model. The AAVE and YFI markets will have a 60,000 and 1,500 borrowing cap, respectively. These new listings showcase the flexibility of the new Chainlink price feed and the solid work from Getty Hill who received a COMP stream in order to manage new asset listings. You can read more about these proposed markets on the accompanying forum thread.

Ongoing Discussions

See below for highlights from the Compound Community Forum, and join in the discussion:

Should Compound Retroactively Airdrop Tokens to Early Users? - @allthecolors shares updated analysis on how early users would be rewarded with a COMP airdrop.

Remove cCOMP borrow cap - The community continues the discussion around removing the cCOMP borrow cap of 100k in light of the recent updates to the governance system.

Add Markets: stETH - @TylerEther shares the deployment specifics for adding stETH as a supported market on Compound.

Reducing gas costs in cTokens#redeemFresh - @TylerEther presents a minor change to the cTokens which reduces gas fees when #redeemFresh is called.

Whitelist of addresses that can create proposals - @Arr00 provides an update on a whitelist of addresses that may create proposals without requiring an accumulation of 65k COMP.

New Listing Proposal: PAXOS Stablecoin (PAX) - The community continues the discussion around adding support for the PAX stablecoin, with a price pegged to $1 or a price feed pulled from Uniswap or Curve.

RFP 16: Dynamic COMP reward distribution - @TylerEther updates the community on a new method for distributing COMP rewards to incentivize market action.

repayBorrow() with cToken - @llama0 recommends a defense against token pausability, having depositors sell their cTokens to borrowers and allowing them to close their position by repaying the cTokens.

Be sure to either vote on proposals with your COMP, or delegate your COMP voting rights to a representative of your choice.

Active RFPs

As a reminder, one of the best ways to participate in, and contribute to, the Compound ecosystem is to complete outstanding Request For Proposals (RFPs). The Compound Grants Program is offering substantial grants to individuals and organizations who work on the topics listed below. Have an idea in mind that's not included on the list? Feel free to apply with your own ideas here!

RFP 1: Decentralized batching contract | $25k

RFP 2: Voting with COMP collateral | $50k

RFP 3: Bringing Compound to L2's and other chains | $50k

RFP 4: Adding support for new assets on Compound | $12.5k

RFP 5: Gas optimizations | TBD

RFP 6: Improvements to the liquidations process | $50k

RFP 7: Uniswap V3 management platforms as collateral | $25k

RFP 8: Balancer V2 liquidity as collateral | $25k

RFP 9: Open source Compound Interface | $50k

RFP 10: Polygon Starport for Compound Gateway | $100k

RFP 11: Ripcord wallet | TBD

RFP 12: Governance/Voters rewards | TBD

RFP 13: cToken Cleanup | $250k

RFP 14: cToken Interest Rate Model Changes | $100k

RFP 15: Gas Savings for cToken and Comptroller contracts | $100k

RFP 16: Dynamic COMP reward distribution | $100k

RFP 17: Migrate legacy cTokens | $50k

RFP 18: Deploy upgradeable cETH contract and migrate users to it | $50k

RFP 19: Uniswap V3 liquidity as collateral | $100k

RFP 20: Interest rate curve research | $5k

RFP 21: Optimism Starport for Compound Gateway | $100k

Developer Community Call Recap

The Compound community held a Developer Community Call on Wednesday to discuss ongoing protocol and application development. You can also access an audio recording of the call here.

Markets Update

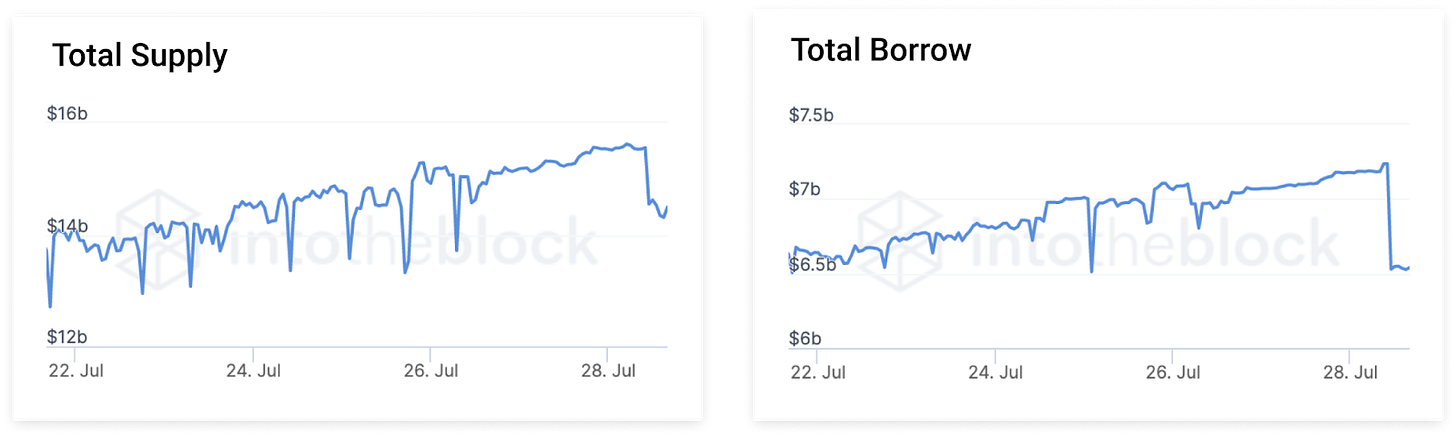

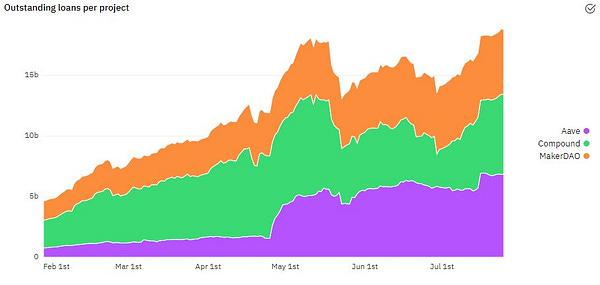

Current supply on Compound is at $16.1B from 294k unique addresses. 31% of this supply volume is USDC, 29% is DAI, and 22% is ETH. (source).

Open borrowing is at $7.6B from 8.4k unique addresses. 46% of this borrowing volume is DAI, 40% is USDC, and 7% is USDT. (source).

For live figures please refer to our Markets page.

Image Source: IntoTheBlock

Links & Discussions

Sense Finance published a blog post on separating Compound’s cTokens into separate principal and yield tokens.

Compound Labs CEO, Robert Leshner, speaks about real-world use cases of the Compound protocol at the SCB10x Virtual DeFi Summit.

Fortune Magazine published an article about DeFi protocols like Compound taking on the incumbent financial system.

Tearsheet covers the launch and features of Compound Treasury.