Updating cREP's Collateral Factor, cDAI Plants (Actual) Trees with rTrees, and More

Compound Digest - January 15, 2020

Welcome to Compound’s first newsletter of the new decade! In this issue, we cover:

A pending (currently in the timelock) update to lower cREP’s collateral factor from 50% to 40%.

rTrees, a new application built on rDAI and cDAI which uses Compound-generated interest to fund the non-profit Trees for the Future.

BeToken’s integration of Compound to power margin trading.

And some fantastic Compound-relevant writing and analysis from friends at Coinbase, a16z Crypto, and Dragonfly Capital.

Read on for details — and join our community’s discussion on Discord and Twitter!

Updating the cREP Collateral Factor to 40%

Augur (REP) has experienced abnormally high volatility the past several days, ranging from ~$10 to as high as ~$23 on major exchanges. As a safety measure, the cREP collateral factor on Compound will be lowered from 50% to 40% pending a 2-day timelock as required by the governance layer of the protocol.

Learn more about collateral factors in the How does collateral work, exactly? section of Compound’s FAQ.

Supply to or borrow from the REP market through Compound’s interface.

Monitor timelock progress in Compound’s governance system. cREP’s collateral factor change becomes executable on January 18 at 1:36am UTC.

Plant (real) Trees Using cDAI

rTrees enables users to generate interest from Compound based on cDAI, and redirect that interest to the non-profit Trees for the Future, which plants trees and plants in conjunction with farmers in developing countries. rTrees shows its users the number of newly planted trees that their cDAI interest is funding, in real-time.

rTrees is actually built on the rDAI (redeemable DAI) token standard, which extends the feature set of cDAI (Compound DAI). Extremely cool “money legos” that is now literally funding the planting of more trees on Earth.

Read more about rTrees and how to use the app in their launch announcement!

Betoken Margin Trading Powered by Compound

Betoken, a platform for community-managed crypto funds, has enabled margin trading powered by Compound for its 172 fund managers.

Betoken fund managers collectively manage a single portfolio of capital, supplied by Betoken users. The portfolio holds 70+ Ethereum-based assets, as well as margin positions on Ether, WBTC, BAT, KNC, REP, and ZRX. Capital is allocated across all 172 fund managers based on investment track record. Check out Betoken here.

More Product Launches

Curve Finance, an experimental (unaudited) liquidity pool for stablecoins (DAI<>USDC), launched an alpha version.

Frontier Wallet, a DeFi-focused mobile wallet, has integrated Compound functionality.

Links & Discussions

Fantastic content from friends at Coinbase, a16z Crypto, and Dragonfly Capital recently. Excited to see Compound as part of the conversation:

A Beginner’s Guide to Decentralized Finance (DeFi), by Sid Coelho-Prabhu of Coinbase

Progressive Decentralization: A Playbook for Building Crypto Applications, by Jesse Walden of a16z Crypto

Liquidators: The Secret Whales Helping DeFi Function, by Tom Schmidt of Dragonfly Capital

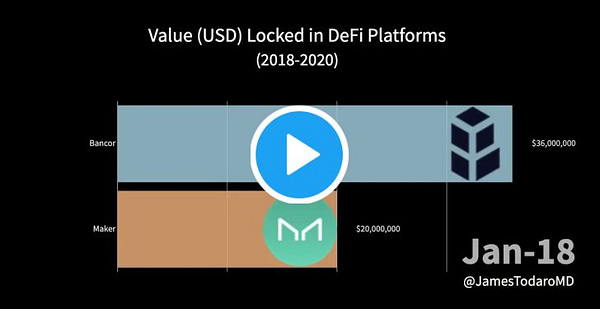

Markets Update

Current supply is at ~$150 million from over 14,000 unique addresses. The biggest suppliers over the past two weeks minted 37k cETH and 1.2 million cREP; 128k cETH; and 30k cETH.

Open borrowing is at ~$31 million from over 1,400 unique addresses. The biggest borrowers over the past two weeks borrowed 3.8 million USDC and 125k REP; 5.8 million DAI; and 1.4 million DAI.

It’s been an exciting two weeks as the total crypto market capitalization, per CoinMarketCap, is up about 25%. For live figures on Compound please refer to our Markets page.