Highlighting the best of the Compound ecosystem. For more updates, join the Compound community on Discord, Twitter, and Comp.xyz.

Compound Treasury now accepts funding via USDC

Compound Treasury now supports USDC as a source of funding, in addition to USD. Customers can earn a fixed 4% with daily liquidity, on more of their cash and cash alternatives.

Funding with USDC was one of the most requested features we heard from our customers. Corporate treasuries and institutions with idle USDC balances wanted an easy, secure way to earn fixed interest.

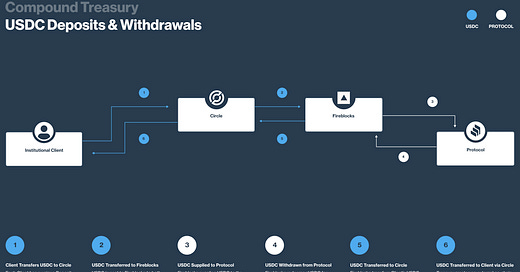

The USDC flow of funds is simple and transparent. During deposit, the Client sends USDC to a unique Treasury deposit address on Circle. The USDC is then sent to Fireblocks, which supplies to the protocol and custodies the asset.

During withdrawal, Fireblocks redeems USDC from the protocol and transfers USDC back to Treasury’s Circle account. Treasury creates an external on-chain transfer from Circle to the Client’s pre-approved withdrawal address.

Start earning a fixed 4% with daily liquidity on USDC at compoundtreasury.com

Compound in the news

The Information - Compound Labs CEO on How Interest Rate Hikes Will Buoy Crypto Lending

Coindesk - Compound Labs Founder on Bridging the Gap Between DeFi and Traditional Finance

The Block - Compound governance rejects proposal wanting to end large token rewards

Governance Updates

The Compound community has reached the 100th governance proposal milestone! Incredible to see the evolution of the protocol led by an engaged community - find all proposals at compound.finance/governance.

Highlighted Proposal

Proposal 100 - COMP Rewards Adjustments - Kickstart Rewards: Step Two

Status: Failed

Proposer: Tyler Loewen

Voting Results: 492,678 For and 499,849 Against

Summary: End the current COMP rewards program and to start a new one with the sole purpose of kickstarting new markets: kickstart rewards. This proposal is the second step towards launching the new rewards program - existing rewards are being slashed to 0.

For more information and discussion, please visit the discussion thread on the forums.

Recent Passed Proposals

Proposal 99 - OpenZeppelin Security Partnership - 2022 Q2 Adjustment V3

Status: Queued April 13th, 2022

Proposer: OpenZeppelin

Voting Results: 912,682 For and 0 Against

Summary: As outlined in the original proposal, at the start of every quarter OpenZeppelin will create a proposal to update the service fee payment in accordance with the formula outlined in the proposal. More details in this forum post.

Proposal 98 - Risk Parameter Updates for YFI and SUSHI

Status: Executed April 11th, 2022

Proposer: Gauntlet

Voting Results: 692,329 For and 0 Against

Summary: Updated Risk Parameters aligning with Moderate Risk Level - increasing collateral factor for cYFI and cSushi from 65% to 70. Gauntlet’s parameter recommendations are driven by an optimization function that balances 3 core metrics: insolvencies, liquidations, and borrow usage. For more details, please see Gauntlet's Parameter Recommendation Methodology and Gauntlet's Model Methodology.

Proposal 97 - Reduced MKR borrow limit

Status: Executed April 11th, 2022

Proposer: MonetSupply

Voting Results: 814,331 For and 0 Against

Summary: This proposal reduces the MKR market's borrow limit from the current value of 25,000 MKR to 5,000 MKR. Lowering the borrow limit makes it more difficult for malicious parties to interfere with MakerDAO governance; full discussion here.

Proposal 92 - COMP Rewards Adjustments - Kickstart Rewards: Step One

Status: Executed March 26th, 2022

Proposer: Tyler Loewen

Voting Results: 883,476 For and 87,585 Against

Summary: End the current COMP rewards program and to start a new one with the sole purpose of kickstarting new markets: kickstart rewards. This proposal is the first step towards launching the new rewards program - existing rewards are being cut by 50%.

Ongoing Discussions and RFPs

See the Compound Community Forum to see and join in the latest discussion.

As a reminder, one of the best ways to participate in, and contribute to, the Compound ecosystem is to complete outstanding Request For Proposals (RFPs)

Click here for a recap of our most recent Developer Community Call, discussing ongoing protocol and application development, and listen to the audio recording here.

Markets Update

Current supply on Compound is at $9.2B from 301k unique addresses. 31% of this supply volume is ETH, 21% is USDC, and 17% is DAI. (source).

Open borrowing is at $3.1B from 9.3k unique addresses. 41% of this borrowing volume is USDC, 38% is DAI, and 14% is USDT. (source).

For live figures please refer to our Markets page.

Image Source: IntoTheBlock