Highlighting the best of the Compound ecosystem. For more updates, join the Compound community on Discord, Twitter, and Comp.xyz.

LINK and TUSD Markets are Live

Last week, COMP token holders voted to add support for LINK and TUSD on Compound, marking the first time that two separate governance proposals for adding assets have been active at once.

The TUSD Market was created with a 0% collateral factor, 7.5% reserve factor, unlimited borrowing cap, and JumpRateV2 interest rate model with a 4.7% borrowing APY at the kink. The price of TUSD is pegged at $1, similar to how the USDC market operates.

The LINK Market was created with a 0% collateral factor, 25% reserve factor, unlimited borrowing cap, and JumpRateV2 interest rate model with a 22.8% borrowing APY at the kink. The proposal to add LINK was developed by TylerEther with help from Arr00 on simulation testing and MasterofNonce on writing the CAP description. This proposal is a great case study on how the community can work together to add new functionality to the protocol with a starting amount of only 100 COMP!

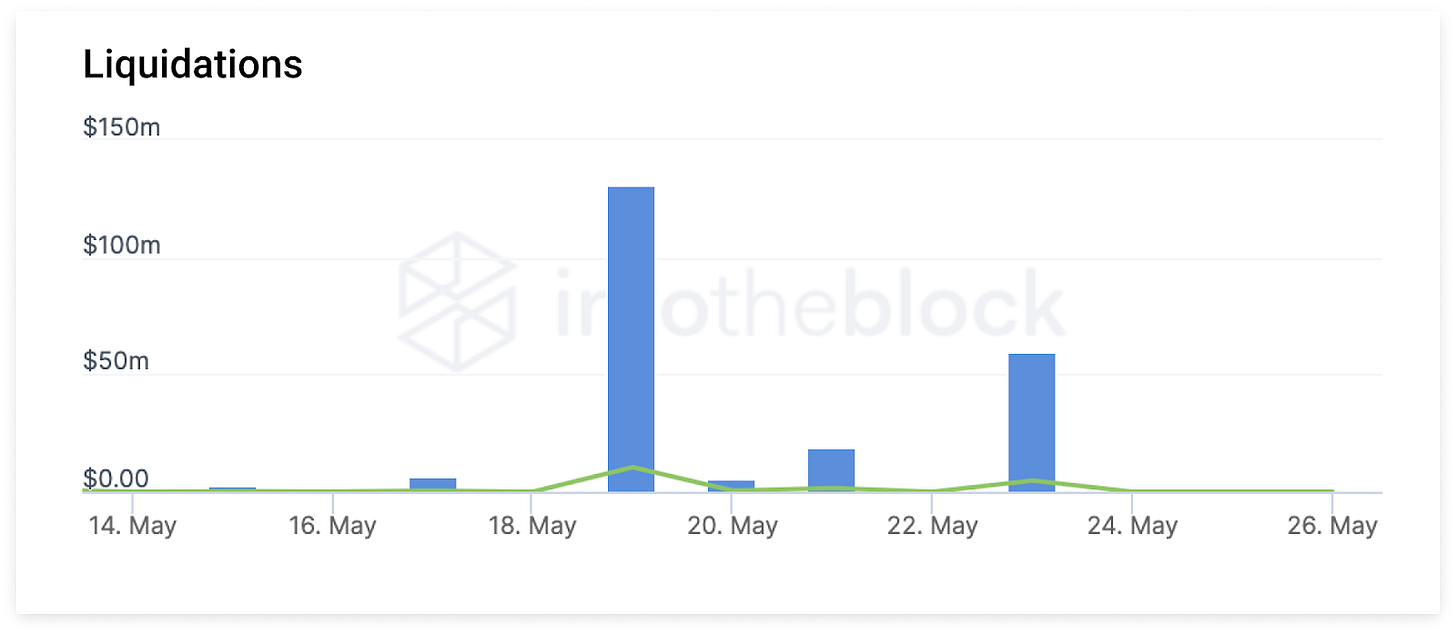

Compound Liquidation Performance

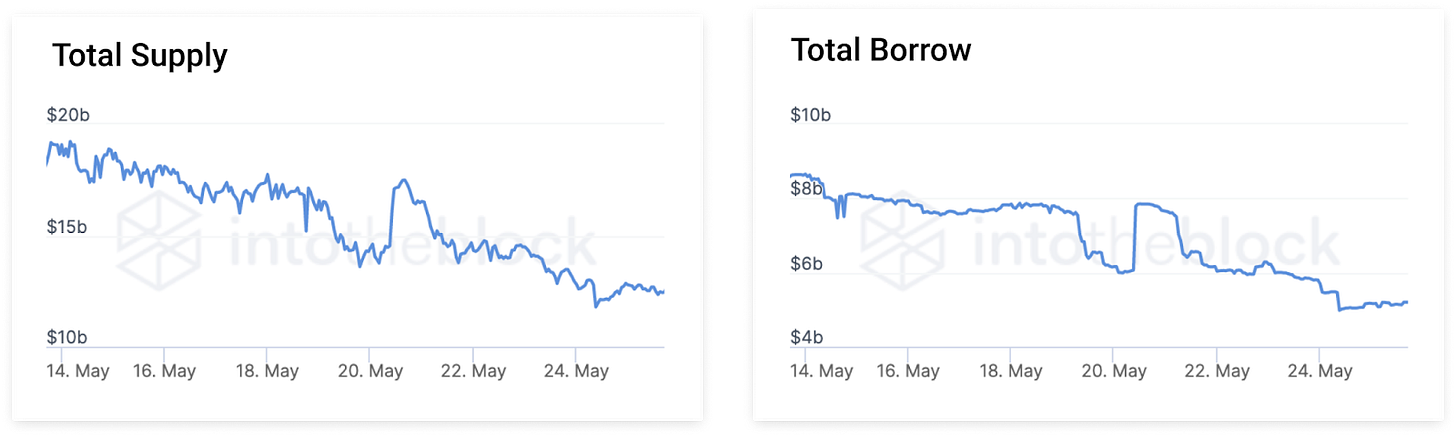

Beginning on May 15th, the crypto market experienced a sharp downtown, as the price of major assets like Bitcoin and Ethereum tumbled roughly 50% from their all-time highs. As highlighted by a research piece from IntoTheBlock, over $200m of collateral assets on Compound were liquidated and $1.7B of borrowed assets were repaid during the downturn, as borrowers sought to de-risk their outstanding positions.

While liquidations are an unfortunate outcome for borrowers, it remains a crucial component for the safety and solvency of the protocol. Compound’s liquidation system performed flawlessly during this period of extreme volatility, ensuring that all suppliers of liquidity remained secure. Integrated leverage products like BTC2x-FLI and ETH2x-FLI, which feature automatic rebalancing, also passed this stress test with flying colors by remaining solvent and avoiding liquidations altogether. All users are encouraged to exercise caution when using leverage on interest rate protocols like Compound.

Governance Updates

Since the last newsletter, Proposals 45 and 46 passed through the governance system with unanimous support from the community.

Completed Votes

Status: Executed May 21st, 2021

Proposer: TrueUSD Team

Voting Results: 1,059,354 For and 0 Against

Summary: Proposal 45 added support for TUSD on the Compound protocol. You can read more about the parameter decisions for the TUSD market on the accompanying forum post.

Status: Executed May 22nd, 2021

Proposer: blck

Voting Results: 971,696 For and 0 Against

Summary: Proposal 46 added LINK as a supported market on the Compound protocol. You can read more about the parameter decisions for the LINK market on the accompanying forum post.

Ongoing Discussions

See below for highlights from the Compound Community Forum, and join in the discussion:

Polygon/Matic Starport - Jared Flatow announces a bi-weekly call for interested developers to discuss building a Gateway Starport on Polygon.

Temperature Check on Proposals for the Addition of YFI, SUSHI, MKR, SNX, and CRV - ParaFi Capital creates a poll to see which asset the community most wants to see listed, with MKR topping the list.

Safety and Gas Patches - Max Wolff discusses the in-progress development of patches to the Comptroller and cToken contracts to increase gas efficiency and overall security.

1INCH Listing Proposal [Stay Tuned] - @CryptoCraig proposes that Compound could utilize 1Inch’s API as a price feed reporter.

Oracle quirks, or why you might get liquidated even at 95% borrow limit - @ennui suggests both smart contract and UI upgrades to the current price feed system, in order to prevent liquidations from MEV transactions.

Compound Risk Monitoring - Wayne Nilsen discusses ideas for an accounting health monitoring system to alert borrowers when their positions are close to the liquidation threshold.

Be sure to either vote on proposals with your COMP, or delegate your COMP voting rights to a representative of your choice.

Active RFPs

As a reminder, one of the best ways to participate in, and contribute to, the Compound ecosystem is to complete outstanding Request For Proposals (RFPs). The Compound Grants Program is offering substantial grants to individuals and organizations who work on the topics listed below. Have an idea in mind that's not included on the list? Feel free to apply with your own ideas here!

Gasless Supply/Redeem

Voting with COMP collateral

Bringing Compound to L2's and other chains

Adding support for new assets on Compound

Gas optimizations

Improvements to the liquidations process

Uniswap V3 liquidity as collateral

Balancer V2 liquidity as collateral

Open source Compound Interface

Polygon Starport for Compound Gateway

Ripcord wallet

Governance/Voters rewards

Developer Community Call Recap

The Compound community held a Developer Community Call last week to discuss ongoing protocol and application development. You can also access an audio recording of the call here.

Markets Update

Current supply on Compound is at $13.1B from 289k unique addresses. 29% of this supply volume is ETH, 25% is USDC, and 23% is DAI. (source).

Open borrowing is at $5.3B from 7.9k unique addresses. 44% of this borrowing volume is DAI, 41% is USDC, and 7% is USDT. (source).

For live figures please refer to our Markets page.

Image Source: IntoTheBlock

Links & Discussions

Compound Labs CEO, Robert Leshner, joins the Fintech Blueprint podcast to discuss the origins of the Compound protocol.

Copper published a report that explores various growth and health metrics for DeFi protocols like Compound.

IntoTheBlock analyzes how the recent market downturn affected borrowing positions on Compound.

The Wharton Blockchain and Digital Asset Project published a report on the fundamentals of DeFi protocols like Compound.

A new Flipside Crypto dashboard from “CRYPGOAT” analyzes the likelihood of liquidation by various collateral assets.

Amxx created a meta-subgraph for Compound governance, allowing users to query on-chain data about governance activity.