Governance Updates, Curv Integration, OKCoin Price Feed, Ankr Q&A

Compound Digest - July 16, 2020

Highlighting the best of Compound & the DeFi ecosystem. For more updates, join our community on Discord, Twitter, and comp.xyz.

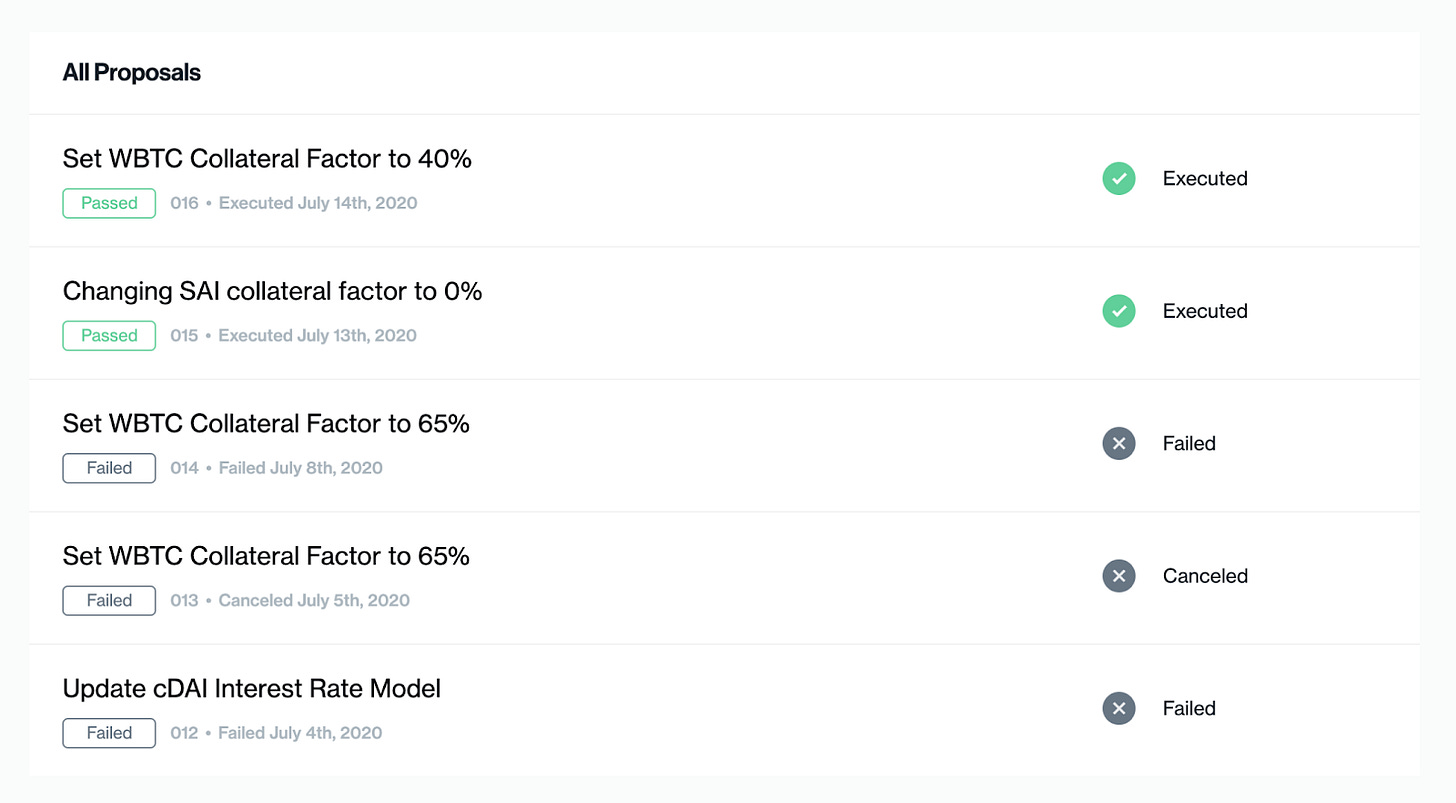

Governance Updates

Five new proposals have passed through Compound’s governance system in July, with two passing, two failing, and one being canceled. Below, we highlight each proposal, from oldest to newest, and the broader significance for users and stakeholders of the protocol.

Proposal 12: Update cDAI Interest Rate Model (012)

Status: Failed July 4th, 2020

Proposer: Dharma

Voting Results: 133,613 For and 538,486 Against

Summary: This proposal from Dharma attempted to make three changes to the interest rate model of cDAI: Increase the supply APY from 15% to 25% at 100% utilization, change the utilization rate ‘kink’ from 90% to 80%, and increase the slope of the interest rate curve before the ‘kink’ (gapPerBlock from 2% to 4%).

Proposal 13: Set WBTC Collateral Factor to 65% (013)

Status: Canceled July 5th, 2020

Proposer: Alameda Research

Voting Results: 125,332 For and 105,049 Against

Summary: This proposal sought to increase the WBTC collateral factor from 0% to 65%, allowing users to supply WBTC as collateral to borrow other assets from the protocol. This proposal was canceled before the end of the voting period, as Alameda’s delegated COMP fell below the 100k threshold.

Proposal 14: Set WBTC Collateral Factor to 65% (014)

Status: Failed July 8th, 2020

Proposer: Alameda Research

Voting Results: 353,204 For and 669,872 Against

Summary: This proposal was a continuation of Proposal 13, where Alameda again proposed a collateral factor increase of 0% to 65% for WBTC. This proposal ultimately failed due to concerns that manipulative WBTC minting would create systemic risk for the protocol.

Proposal 15: Changing SAI collateral factor to 0% (015)

Status: Executed July 13th, 2020

Proposer: blck

Voting Results: 997,005 For and 9 Against

Summary: blck completes the process of deprecating SAI by reducing SAI's Collateral Factor from 35% to 0%.

Proposal 16: Set WBTC Collateral Factor to 40% (016)

Status: Executed July 14th, 2020

Proposer: Alameda Research

Voting Results: 533,998 For and 523,974 Against

Summary: In the closest voting outcome in governance thus far, Alameda passed a proposal for a WBTC collateral factor of 40%. The proposal explained that while they still support taking WBTC collateral factor up to 65%, they believe 40% is a good middle ground for the community to get comfortable with having WBTC as collateral for borrowing.

Join the Compound governance discussion on Comp.xyz, or delegate your COMP voting rights to the delegate of your choice. Leading delegates can be seen on the Delegate Leaderboard.

Curv Supply Integration

Curv is an institutional custodian that uses multi-party computation (MPC) to remove single points of failure in public-key cryptography, and better secure digital assets. The team recently announced a successful Series A fundraising round from investors including CommerzVentures, Coinbase Ventures, Digital Garage Lab Fund, Digital Currency Group, and Team8, and counts eToro, Genesis, and Franklin Templeton Investments as clients.

Curv has integrated Compound’s supply functionality so their institutional clients can earn interest on crypto from the safety of custody. The initial integration will support ETH, with other assets and borrowing being added in the near future.

You can visit Curv's website for more information on the Compound integration and request a demo.

OKCoin Open Price Feed

OKCoin, a leading exchange based in San Francisco, has released a signed price feed based on the Open Price Feed standard, which allows any DeFi project to pull OKCoin’s price data into their markets. The Open Price Feed is designed for Reporters like OKCoin to sign price data with a public key, and then have those prices posted on-chain. Any on-chain application can request and decode data out of the Open Price Feed.

Compound CEO Robert Leshner added that “Having a reliable feed for on-chain price data is critical for DeFi growth and use of Compound. This effort from OKCoin is an important contribution to the decentralized finance ecosystem”.

Ankr Q&A

Ankr is a blockchain Node-as-a-Service provider that builds essential infrastructure for deploying proof of stake and Ethereum nodes. The Ankr team recently launched a Compound API that abstracts away Solidity development and replaces it with a developer-friendly web2-stack. The node deployment and API solutions at Ankr lower the entry barrier for anyone looking to build applications and experiences on top of the Compound protocol.

How can devs use your product with Compound to build something awesome?

Developers who have experience with RESTful API’s integration can easily work with the Compound API provided by Ankr to interact with Compound's functionalities, which are only exposed via Solidity.

What does your tech stack look like?

We power our Compound API using Kubernetes, MySQL, and Node.js. However, you don't need to write any code to launch or maintain this Compound API. All the bootstrap steps can be easily done via a couple of clicks. What's more important, you don't need to maintain an Ethereum node yourself to interact with smart contracts. Ankr internally provides its own Ethereum Full node to facilitate all the Ethereum calls.

Is there anything notable or unique regarding your Compound integration or research?

In our opinion, security is even more important than ease-of-use. We have built our application with security in mind since day 1.

All the data saved in the database is either hashed or encrypted.

No plain text is allowed for sensitive data such as private keys over the Internet.

Ankr has no capability to steal any assets as we are only viewing your database.

What are the next steps and goals for your company?

We are working on immersing with more customers and creating connections in our community, expanding and integrating with more companies and blockchain projects. We are constantly improving our UI/UX for our suite of services. We are also aiming at strengthening our resource network and expanding our operations to locations around the globe.

Marco Robustelli, CMO, Ankr

You can learn more about Ankr’s Compound API by reading the announcement on the Ankr Blog or trying out Ankr’s Compound API deployment page on their website.

Markets Update

Current supply on Compound is at $1.7B from ~32k unique addresses. In the past seven days, approximately $930mm (gross) was added to Compound, in 9.5k transactions. 51% of this volume was DAI, 41% was ETH, 16% was USDC, and 4% was USDT.

Open borrowing is at $1B from 4.5k unique addresses, marking the first time borrowing volumes have exceeded the billion-dollar threshold. In the past seven days, approximately $870mm (gross) was borrowed from Compound in 7k transactions. 61% of this volume was DAI, 22% was ETH, and 10% was USDC.

DAI has replaced BAT as the largest market on Compound, with $880mm of supply and $800mm of open borrowing at the time of publication. This is largely due to the interest rate model of the DAI market, which has a relatively flat slope until a ‘kink’ at 90% utilization. Since COMP rewards are now based on USD amounts instead of interest generated, users have flocked to the DAI market where they can earn the most amount of COMP while paying the least amount of interest.

For live figures please refer to our Markets page.

Links & Discussions

Compound has published a guide for Delegation and Voting with EIP-712 Signatures.

Coindesk analyzes the explosion of DAI volumes on Compound as users maximize COMP rewards.

An investment firm in New Zealand called Techemy Capital plans to launch innovative investment products on top Compound.

Coindesk reports on Compound passing the $1B milestone for open borrowing volume.

Coindesk explores how liquidity mining in DeFi has driven locked value to all-time highs.

The Block provides a variety of data visualizations around the growth of DeFi protocols.

The Block reports on Compound becoming the largest DeFi protocol by TVL.

Deribit, the popular derivatives exchange, provides an overview of the growth, opportunities, and risks in DeFi.

Forbes writer Matt Hougan explains why the concept of programmable money has made Etheurm both valuable and useful.

Dan Elitzer of IDEO CoLab Ventures and Will Price of Flipside Crypto discuss liquidity mining's impact on the DeFi space on Laura Shin’s Unchained Podcast.