Developer Community Call Recap, Governance Updates

Compound Digest - January 19, 2021

Developer Community Call Recap

The Compound community held a Developer Community Call last Wednesday to discuss ongoing protocol and application development. Below is a brief overview of the topics covered. You can listen to an audio recording of the call here or on your favorite podcast platform, or watch a video recording of the call here.

Arr00 showed a demo of Comp.vote, which adds votes and delegations to a server queue that are then batched into a single transaction to save on gas costs. Arr00 is currently relaying all these signatures himself and is open to community feedback on how to scale this process as Compound governance grows. Arr00 also shared more information about Governor Bravo, a new governance implementation that allows for incremental changes and parameter tweaking. A full list of features and community feedback for Governor Bravo can be found on the original forum post. Arr00 plans to make the code available for community review later this week, with a formal audit likely the following week.

Tarun Chitra and Peteris Erins walked the community through Gauntlet’s newest pull request for COMP vesting, which uses a cooldown method rather than the fixed-period vesting previously outlined in pull request #71. While the cooldown method requires an extra step compared to vesting, the Gauntlet team believes that the gas cost reductions and code simplification make the switch worth the additional UX challenges. Before users can claim any accrued COMP, they will first need to call the cooldown function, which makes the accrued COMP available to be claimed after the number of blocks specified by the cooldownPeriod. (It is assumed that integrated applications will add a cooldown button to their interfaces.) If the user calls the cooldown function again while the first one is still in progress, the accrued COMP will be batched together and available to be claimed at the end of the second cooldownPeriod. If the user calls the cooldown function after the first one is completed but the COMP is not yet claimed, the accrued COMP in the first cooldownPeriod will automatically be claimed and a new cooldownPeriod will start for any remaining accrued COMP. Governance will be able to set and modify the duration of the cooldownPeriod with the _setCooldownPeriod function. The Gauntlet team is actively looking for feedback on how to optimize the user experience for this implementation, so please DM @Tarun in the Compound Discord with any feedback.

As a reminder, the community holds bi-weekly calls every other Wednesday at 9:30am PT / 4:30pm GMT. The next call will be on January 27th in the Compound Discord. Save the Google Calendar invite here. We hope to see you on the next call!

Governance Updates

Since the last newsletter, Proposal 35 passed through governance with near-unanimous support from the community.

Completed Votes

Proposal 35: COMP Speed Recalibration

Status: Executed January 13th, 2021

Proposer: Gauntlet

Voting Results: 631,909 For and 278 Against

Summary: Proposal 35 modified the COMP distribution for each of Compound’s markets, based on the numbers provided by @Sirokko in the community forum. An overview of @Sirokko’s changes is listed in the table below. The new distribution gives each of the 9 active markets 10% of the total rewards, with the excess going towards collateral (WBTC, ETH) and stablecoin (USDC, DAI) markets. Since going live, the proposal has encouraged a healthy distribution of supply and borrow volume across various markets. Borrowing volume for collateral assets like ETH and WBTC has more than doubled, as the increased COMP distribution has created a net positive borrowing rate of 2.0% APY and 4.0% APY, respectively. As the effects of the COMP speed recalibration become more apparent over time, the community should feel empowered to analyze the results and further tweak the parameters. The COMP distribution is a powerful tool for incentivizing behavior that will maximize the long-term value of the protocol, and we’re excited to see how the community will optimize it going forward.

CAPs

Getty Hill created a Compound Autonomous Proposal to increase the WBTC collateral factor from 60% to 75%. As Getty explains in the proposal details, this increase is warranted based on the much larger supply of WBTC in circulation ($4.38B today vs ~$1B on October 1), the increased liquidity on DEXes, the growing adoption of WBTC among centralized exchanges (Coinbase being the most recent example), and competitive collateral factors on other DeFi protocols. Consider delegating your support to this CAP, or follow this guide to create your own if you have at least 100 COMP.

Ongoing Discussions

See below for highlights from the Compound Community Forum, and join in the discussion:

Rewarding Contributors - @lay2000lbs proposes a set of norms for compensating community members who contribute to the development of the protocol.

Governor Bravo Development - @Arr00 describes a feature list for the updated Governance implementation that he and @Blurr have been working on.

Temperature Check Meta-Proposal to add PcUNI to cUNI Snapshot - @Brendan from PoolTogether suggests adding PcUNI token to the cUNI Snapshot, so PoolTogether users can participate in Uniswap governance proposals.

COMP Contributors, Grants, Bounties, DAO - @massnomis proposes a new grant process and provides examples from other popular DeFi protocols.

Be sure to either vote on proposals with your COMP, or delegate your COMP voting rights to a representative of your choice.

Markets Update

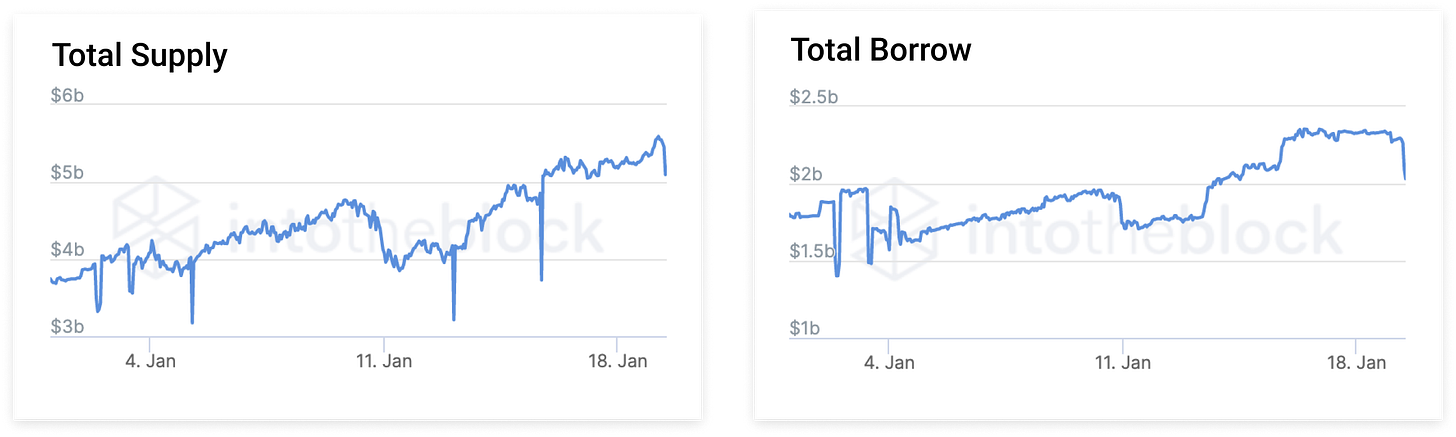

Current supply on Compound is at $5.2B from ~276k unique addresses, setting a new record for supplied assets. 30% of this supply volume is ETH, 25% is WBTC, and 22% is USDC. (source).

Open borrowing is at $2.1B from 6.8k unique addresses. 47% of this borrowing volume is USDC, 34% is USDC, and 7% is USDT. (source).

For live figures please refer to our Markets page.

Image Source: IntoTheBlock

Links & Discussions

Compound Labs CEO, Robert Leshner, joins a Blockworks webinar to discuss institutional adoption of DeFi.

DappRadar notes that Compound transaction volume increased by 528% at the start of the new year.

Compound community member Matt Solomon updated the Compound Rates website to include support for COMP, UNI, and USDT.

Opyn, an options marketplace built on top of Compound, has launched Opyn v2 with improved capital efficiency.

Compound Labs CEO, Robert Leshner, joins Circle CEO, Jeremy Allaire, in an episode of The Money Movement video series to discuss DeFi and the future of capital markets.

Dennison Bertram created a Tally Governance Tutorial project for deploying Compound’s on-chain governance system.

In an article for Blockworks, Compound Labs General Counsel, Jake Chervinsky, explains why the regulatory threat to digital assets is greatly exaggerated.

ARCx launched a partially collateralized stablecoin called STABLEx that uses cUSDC as a collateral option.

DerivaDEX created the DerivaDEX insurance mining program that uses cUSDT and cUSDC as staking assets.