Compound Chain Announcement, Crypto.com Integration, Developer Community Call Recap, Governance Updates

Compound Digest - December 17, 2020

Highlighting the best of the Compound ecosystem. For more updates, join the Compound community on Discord, Twitter, and Comp.xyz.

Compound Chain Announcement

Today, Compound Labs released the whitepaper for Compound Chain, a stand-alone distributed ledger capable of transferring value & liquidity between peer ledgers. Compound Chain is a Byzantine Fault Tolerant proof-of-authority (PoA) blockchain that seeks to improve on certain limitations of Compound V2, including (1) a shared risk model that limits the universe of acceptable collateral; (2) high transaction costs that price out smaller transactions; and (3) the inability to support non-Ethereum based assets. As reported in a Coindesk article on the announcement, the interoperability of Compound Chain could pave the way for money market services for a variety of different asset types, including Eth2 or central bank digital currencies.

Compound Chain also introduces a native unit of account, CASH, which is generated by the protocol through borrowing (similar to DAI), and can be used to pay transaction fees on the network. COMP token holders will govern Compound Chain through the existing governance system on Ethereum, with the ability to set genesis conditions and update system parameters.

The Compound Labs team is currently working on a testnet environment with a limited feature set, which is expected to ship in Q1 of 2021. We look forward to hearing the community’s feedback and invite you to build the future of finance with us on Compound Chain!

Crypto.com Integration

Crypto.com launched a native Compound integration inside of their DeFi Wallet, a new iOS and Android mobile app where users retain full control of their crypto and private keys. The integration supports all of Compound’s markets, features instant adds and withdrawals, automatic COMP rewards, and a 0.5% withdrawal fee. The integration currently only supports supply functionality, with no details yet on borrowing.

This integration further demonstrates how centralized exchanges can be effective access points for DeFi by abstracting away smart contract interactions and presenting an intuitive experience for users. Crypto.com benefits from fee revenue and new features for users, and the Compound community benefits from additional liquidity and interfaces to the protocol - a big win-win!

You can view more details about the integration on the accompanying blog post and help page, and try it out today on the iOS or Android app store.

Developer Community Call Recap

The Compound community held its fourth Developer Community Call last week to discuss ongoing protocol and application development. Below is a brief overview of the topics covered. You can view a longer recap on the Compound Community Forum, and listen to a recording of the call here or on your preferred podcast platform

Tarun Chitra shared an update on Gauntlet’s COMP grant proposal, which passed through governance on December 5th, and COMP vesting proposal, which will be submitted to governance after a community-led code review, which is planned to be held sometime before Christmas.

Wesley van Heije discussed his project Tokenlog, which allows COMP holders to vote on development topics that are important to them, rather than just voting on individual proposals in the formal governance process.

Dennison Bertram shared a preview of Tally’s DeFi governance portal, which allows users to participate in Compound governance and view insightful data on past proposals and top advocates.

Zefram Lou explained the inner workings of the EMA oracle that 88mph leverages for its fixed and floating rate interest calculations.

As a reminder, the community holds bi-weekly calls every other Wednesday at 9:30am PT / 4:30pm GMT. The next call will be on December 23rd in the Compound Discord. Save the Google Calendar invite here. We hope to see you on the call next week!

Governance Updates

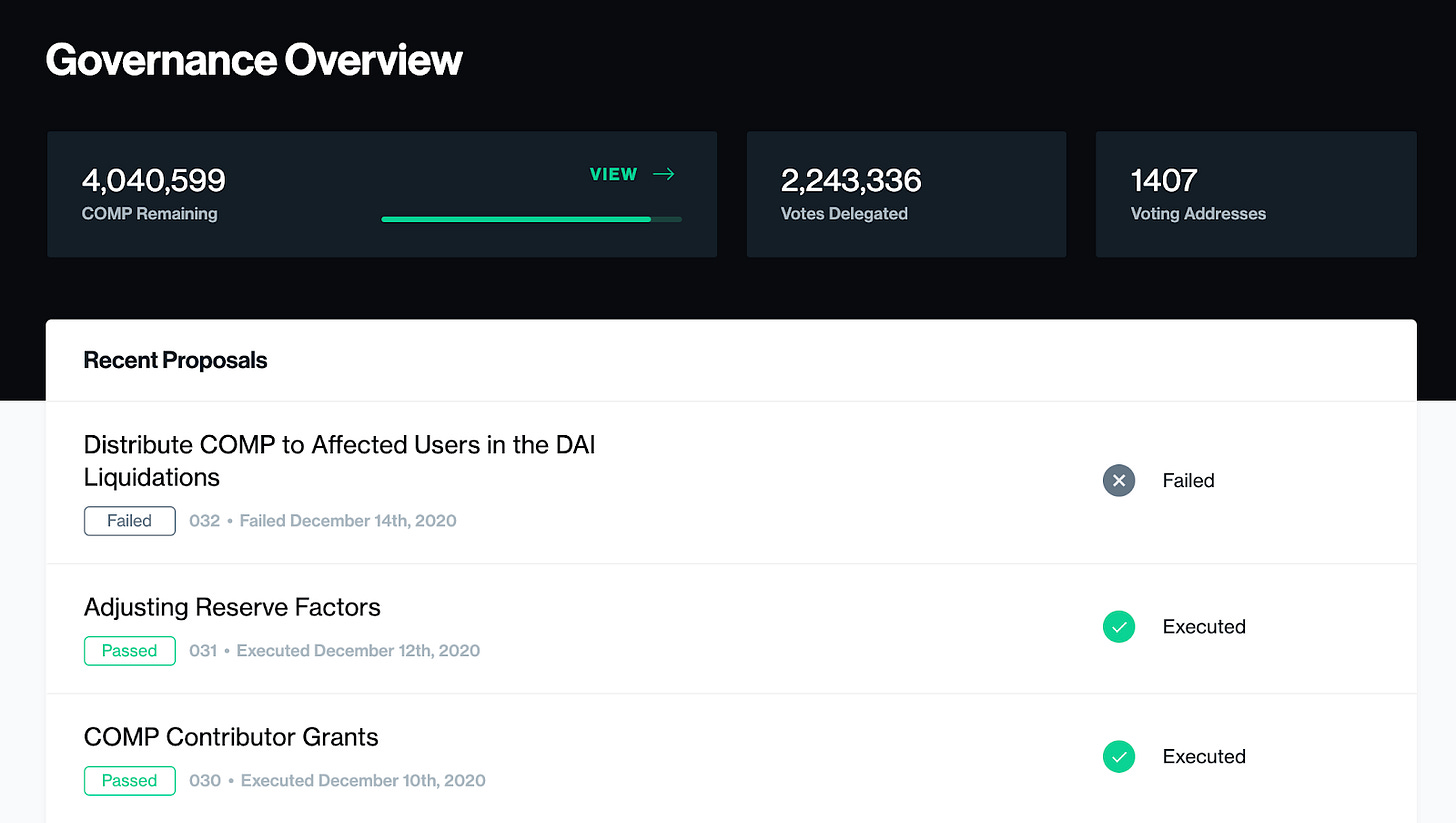

Since the last newsletter, Proposals 30 and 31 passed through governance with near-unanimous support from the community, and Proposal 32 failed after high voter participation on each side.

Completed Votes

Proposal 30: COMP Contributor Grants

Status: Executed December 10th, 2020

Proposer: Gauntlet

Voting Results: 1,186,440 For and 135 Against

Summary: Proposal 30 added the ability for governance to vote on directly sending a certain amount of COMP from the Comptroller contract to a specified address. This functionality is achieved through the _grantComp function, which sends a one-time COMP distribution to an address, as well as the _setContributorCompSpeed function, which streams a COMP distribution over a specified period of time. As discussed in detail on the forum post, this proposal also included a grant of 1,000 COMP to Gauntlet, to cover the development and audit costs on this proposal, as well as 2 upcoming proposals for adding COMP vesting and setting the vesting parameters. The ability for governance to issue COMP grants presents a huge window of opportunity for open source developers to contribute to the protocol’s codebase, and get rewarded for their work. The entire community will benefit from these grants as Compound becomes a hub for developer activity and COMP gets put in the hands of users who are aligned with the protocol’s long-term success. Everyone in the Compound ecosystem should feel empowered to use these incentive mechanisms to grow and improve the protocol.

Proposal 31: Adjusting Reserve Factors

Status: Executed December 12th, 2020

Proposer: blck

Voting Results: 856,226 For and 14 Against

Summary: Proposal 31 updated the Reserve Factor for each asset in the protocol, in order to more accurately reflect the risk associated with borrowing the asset. As discussed in length on the original forum post, reserve factors are an important tool in incentivizing market behavior (by increasing/reducing the supply interest rate), as well as providing a pool of funds that governance can allocate at its discretion. The standardization of reserve and collateral factors based on asset risk can serve as a template for selecting these parameters on new assets added to the protocol. A summary of reserve factor changes is listed below:

USDC 5% to 7.5%

DAI 5% to 15%

ETH 10% to 20%

WBTC 10% to 20%

UNI 20% to 25%

COMP 20% to 25%

USDT 20% to 7.5%

BAT 50% to 25%

ZRX 50% to 25%

Proposal 32: Distribute COMP to Affected Users in the DAI Liquidations

Status: Failed December 14th, 2020

Proposer: kybx86 (CAP)

Voting Results: 212,952 For and 681,290 Against

Summary: Proposal 32 failed to pass through the voting process but highlighted some of the best community-led analysis and discussion in the protocol’s history. This proposal sought to use the newly added _grantComp function to distribute 55,254.95 COMP to the 121 Compound users affected by the November 26th DAI liquidation event, proportional to the amount liquidated from each user. The COMP distribution math is based on the 8% liquidation penalty and a 14-day average COMP price of $123.39, and would have allocated 0.55% of the fully diluted COMP supply to the affected users. Proponents of the proposal made the case that although the reimbursement amounts did not match each addresses’ exact loss amount (depending on the type of collateral liquidated), compensation would restore borrower confidence with minimal impact on the total COMP reserves. Opponents of the proposal argued that the Open Price Feed should be strengthened before any compensation considerations, reimbursement should not be going towards yield farmers who are not long term aligned with the protocol, and compensation sets a dangerous precedent in a case where the protocol worked as designed (though not as expected). After the defeat of the proposal, community members are discussing putting forth another proposal that more accurately compensates users based on the value of their liquidated collateral, instead of 8% across the board. A summary of relevant resources and highlighted voting opinions are listed below:

CAPs

Compound community member @Arr00 has created an autonomous proposal entitled Semi-Permanent Gas Saving Measures for the DAI Market, which would switch the cDAI contract to a Non-DSR (Dai Savings Rate) implementation in order to save on gas fees while the DSR is at 0%. This proposal would also update the interest rate model to the same one implemented on cUSDT, since the current IRM takes into account the DSR. You can read more information about the CAP and estimated gas savings on the community forum post. Consider delegating your support to this CAP, or follow this guide to create your own if you have at least 100 COMP.

Ongoing Discussions

See below for highlights from the Compound Community Forum, and join in the discussion:

Community Multisig (4-of-6) Deployment - @TennisBowling has replaced @aaaaaaaaaaaaa in the Compound Community Multisig.

Proposal to Integrate ChainLink Price Feeds - The community continues the discussion around the pros and cons of potentially using price data from ChainLink.

Compensation Proposal: Distribute COMP to Affected Users in the DAI Liquidations - @Tennisbowling suggests a governance vote to include OKEx as an additional reporter in the Open Price Feed.

Be sure to either vote on proposals with your COMP, or delegate your COMP voting rights to a representative of your choice.

Markets Update

Current supply on Compound is at $3.7B from ~268k unique addresses. In the past seven days, approximately $1.4B (gross) was added to the protocol, in 41.3k transactions. 38% of this volume was ETH, 38% was USDC, 10% was DAI, and 9% was USDT (source).

Open borrowing is at $1.9B from 6.6k unique addresses. In the past seven days, approximately $312M (gross) was borrowed from Compound in 1.7K transactions. 80% of this volume was USDC, 11% was DAI, 6% was USDT, and 3% was WBTC. (source).

For live figures please refer to our Markets page.

Image source: IntoTheBlock.

Links & Discussions

Cointelegraph reports on how centralized exchanges are increasingly adopting DeFi protocols like Compound.

Compound Labs CEO Robert Leshner speaks about the growth of DeFi on the Messari 2020 Year in Review.

Compound community member Tennisbowling created a podcast page for the Compound Developer Community call recordings.

Compound Labs CEO Robert Leshner joins The Coinist Podcast to discuss investing in the DeFi ecosystem.

Instadapp launched new COMP claiming and delegating functionality inside of their DeFi management dashboard.

DappRadar analyzes the increase of daily active wallets on Compound as a result of voting on proposal 32.

DeFi Rate’s Jack Sun reports on the COMP grant functionality introduced by Gauntlet in Proposal 30.

Nate Parton of Tally takes a deep dive into meta-governance systems, including Compound’s implementation of cCOMP and cUNI voting.