Coinbase Launches Compound Integration, Protocol Auditing Proposals, MakerDAO Deposit Module to Compound

Compound Digest - December 17, 2021

Highlighting the best of the Compound ecosystem. For more updates, join the Compound community on Discord, Twitter, and Comp.xyz.

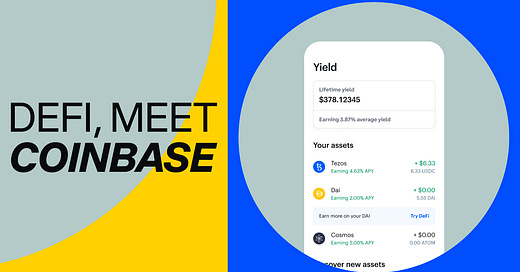

Coinbase Launches Compound Integration

On December 9th, Coinbase announced a new DeFi Yield product that allows users to earn a variable interest rate on DAI, powered by the Compound protocol in the backend. The integration features instant liquidity, no Ethereum gas fees, and support for customers in 70+ countries. The US is not currently a supported region, however, Coinbase plans to expand the product to additional assets, protocols, and jurisdictions in the future.

Coinbase provides a simple, intuitive user experience for opting into DeFi Yield, which will help onboard a new wave of users and liquidity to the Compound ecosystem. This integration highlights the power of composability in DeFi and marks a major step forward in bringing open finance to the masses.

Protocol Auditing Proposals

Since the original forum thread was posted on November 3rd, the Compound community has been evaluating various proposals from blockchain auditing firms to be the ongoing security expert for the protocol. The scope and skillset of each firm’s proposals varies slightly, however, the overarching goal is to ensure that the community avoids future situations where flawed code is added to the Compound codebase, as demonstrated by the bug introduced in Proposal 62.

There are currently three competing proposals from OpenZepellin, Trail of Bits, and ChainSecurity, all which seek a COMP stream in order to kick off the security engagement. The proposal with the most “yes” votes will be the winning proposal, and any other proposals that pass with less votes will be cancelled by the community multi-sig.

These proposals are a landmark move to a “B2DAO” economic system, where technology vendors can directly pitch valuable services to the community in exchange for some portion of the treasury. This can hopefully serve as an industry-wide model for vendor selection in DeFi and bring greater efficiency and security to a variety of projects.

MakerDAO Deposit Module to Compound

The MakerDAO community is evaluating a proposal from GFXLabs to add Compound as a destination for the DAI Direct Deposit Module (D3M). This integration would allow Maker to send idle liquidity to the Compound protocol in order to boost revenues and diversify counterparty risk across Compound and Aave. Compound and Maker community members are encouraged to share their thoughts on the proposal in the forums.

Governance Updates

Since the last newsletter, Proposals 71 - 74 passed through the governance system with broad community support, Proposal 70 failed, and Proposals 75 - 77 are in the active voting stage.

Active Votes

Proposal 77: Continuous Security Engineering for Compound

Status: Active 1 Days, 6 hrs left

Proposer: Trail of Bits

Voting: 57,555 For and 3,353 Against

Summary: Proposal 77 would stream the equivalent of $1m of COMP to Trail of Bits every quarter for one year, in exchange for continuous auditing services. The proposal from Trail of Bits encompasses consulting services, security engineering, and process creation, with the goal of preventing faulty code from being merged into the protocol. The proposed services from Trail of Bits will not cover continuous monitoring of the existing codebase or the expansion of a bug bounty program. A detailed breakdown of Trail of Bits’ proposed services can be found on the proposal description.

Proposal 76: OpenZeppelin Continuous Audit & Security Services Proposal

Status: Active 1 Days, 6 hrs left

Proposer: OpenZeppelin

Voting: 585,594 For and 3,254 Against

Summary: Proposal 76 would stream the equivalent of $1m of COMP to OpenZeppelin every quarter for one year, in exchange for continuous auditing services. OpenZeppelin has revised its earlier proposal to reduce the scope of the engagement and remove the associated performance fee. As a part of this proposal, OpenZeppelin will provide a dedicated security advisor to establish better processes for protocol upgrades, perform continuous audits on new proposals, create security checklists, implement a security dashboard for the community to review, and analyze other safety measures like bug bounties and formal verification. More information can be found on the proposal description and this final proposal document.

Proposal 75: Decentralized long-term security for Compound

Status: Active 1 days, 6 hrs left

Proposer: ChainSecurity

Voting: 0 For and 3,353 Against

Summary: Proposal 75 would send a total of $960k COMP to ChainSecurity for its auditing proposal, with $340k being sent an upfront payment to establish an auditor training program, and $620k being streamed per quarter as a project maintainer. ChainSecurity takes a different approach from OpenZeppelin and Trail of Bits, by proposing that the community select two independent auditors to review future governance proposals. The overarching goal is to create a broad audit suite that minimizes dependency on a single company and establishes a repeatable process for onboarding new auditors. More information on ChainSecurity’s proposal can be found on the proposal description.

Proposal 74: Risk Parameter Updates for WBTC, BAT, and LINK

Status: Queued December 17th, 2021

Proposer: Gauntlet

Voting: 907,168 For and 0 Against

Summary: Proposal 74 increases the collateral factors of the following markets: WBTC2 from 65% to 70%, BAT from 60% to 65%, and LINK from 65% to 70%. Note that Proposal 72 aimed to make the same change to WBTC but was executed on a deprecated version of the cWBTC contract. The increased capital efficiency for these markets follows the Moderate Risk Level selected by the Community. These changes reflect an ongoing task of the Gauntlet team as a part of the Dynamic Risk Parameters initiative. More information is available on the original forum thread.

Completed Votes

Proposal 73: Add Markets: USDP

Status: Queued December 16th, 2021

Proposer: Tyler Loewen

Voting Results: 703,357 For and 108,741 Against

Summary: Proposal 73 would add Pax Dollar (USDP) to the Protocol’s list of supported assets. Tyler argues USDP’s regulated state and staunch USD-collateral requirements makes USDP an attractive addition. USDP would be added with a standard 0% collateral factor, 25% reserve factor, no COMP rewards, and the Uniswap-anchored Chainlink price oracle. More information on this Proposal can be found on the accompanying forum thread.

Proposal 72: Risk Parameter Updates for WBTC, UNI, and COMP

Status: Executed December 8th, 2021

Proposer: Gauntlet

Voting Results: 1,045,592 For and 0 Against

Summary: Proposal 72 increases the collateral factors of the following markets: WBTC from 65% to 70%, UNI from 60% to 70%, and COMP from 60% to 65%. The increased capital efficiency for these markets follows the Moderate Risk Level selected by the Community. These changes reflect an ongoing task of the Gauntlet team as a part of the Dynamic Risk Parameters initiative. More information is available on the original forum thread.

Proposal 71: Risk Parameter Updates for DAI, BAT, ZRX, and ETH

Status: Executed November 27th, 2021

Proposer: Gauntlet

Voting Results: 1,006,131 For and 0 Against

Summary: Proposal 71 increases the collateral factors of the following markets: DAI from 75% to 80%, BAT from 65% to 60%, ZRX from 65% to 60%, and ETH from 75% to 80%. The decreased capital efficiency for the BAT and ZRX markets follows the Conservative Risk Level, and the increased capital efficiency for the DAI and ETH markets follows the Aggressive Risk Level selected by the Community. These changes reflect an ongoing task of the Gauntlet team as a part of the Dynamic Risk Parameters initiative. More information is available on the original forum thread.

Proposal 70: Security Solutions For Compound Governance

Status: Failed November 25th, 2021

Proposer: OpenZeppelin

Voting Results: 120,194 For and 580,247 Against

Summary: Similar to Proposal 76, Proposal 70 is OpenZeppelin’s bid to become the Compound Protocol’s continuous auditor in exchange for a COMP streaming grant. This proposal included a performance fee and a wide scope of services, which are detailed on the original forum thread. The proposal ultimately failed, in order to allow the community to evaluate competing proposals from Trail of Bits and ChainSecurity.

Ongoing Discussions

See below for highlights from the Compound Community Forum, and join in the discussion:

Risk Parameter Updates 2021-12-11 - @pauljlei from Gauntlet presents the results from the Dynamic Risk Assessments.

Auditing Compound Protocol - @sukernik outlined an audit selection process for the community to evaluate all three proposals and choose a vendor.

Add Market: LUSD - @chaser picks back up the discussion around adding LUSD as the next supported market on Compound.

FRAX Listing Proposal - @pauljlei from Gauntlet adds to this discussion with an endorsement for FRAX as a collateral asset based on Gauntlet’s market risk assessment.

Compound Deployment on Numio - In Development - @ansteadm, one of Numio’s co-founders, updates the Compound community on Numio’s work to provide L1 and L2 DeFi support.

[RFP12 Implementation] cToken Cleanup - @getty highlights the danger of adding new assets to the protocol which are inflationary, deflationary, or rebasing in nature.

Enable transfer ETH from Timelock - @arr00 proposes deprecating a line of code in Governor Bravo to allow the community to access and spend the recently supplied ETH in the Protocol Timelock.

Migrate Contributor COMP Stream to Sablier - @maxdesalle explores using Sablier, an on-chain money stream creator, for COMP streams paid to vendors or contributors in a more secure and efficient manner.

Be sure to either vote on proposals with your COMP, or delegate your COMP voting rights to a representative of your choice.

Active RFPs

As a reminder, one of the best ways to participate in, and contribute to, the Compound ecosystem is to complete outstanding Request For Proposals (RFPs). The Compound Grants Program is offering substantial grants to individuals and organizations who work on the topics listed below. Have an idea in mind that's not included on the list? Feel free to apply with your own ideas here!

RFP 1: Decentralized batching contract | $25k

RFP 2: Voting with COMP collateral | $50k

RFP 3: Bringing Compound to L2's and other chains | $50k

RFP 4: Adding support for new assets on Compound | $12.5k

RFP 5: Gas optimizations | TBD

RFP 6: Improvements to the liquidations process | $50k

RFP 7: Uniswap V3 management platforms as collateral | $25k

RFP 8: Balancer V2 liquidity as collateral | $25k

RFP 9: Open source Compound Interface | $50k

RFP 10: Ripcord wallet | TBD

RFP 11: Governance/Voters rewards | TBD

RFP 12: cToken Cleanup | $250k

RFP 13: cToken Interest Rate Model Changes | $100k

RFP 14: Gas Savings for cToken and Comptroller contracts | $100k

RFP 15: Dynamic COMP reward distribution | $100k

RFP 16: Migrate legacy cTokens | $50k

RFP 17: Deploy upgradeable cETH contract and migrate users to it | $50k

RFP 18: Uniswap V3 liquidity as collateral | $100k

RFP 19: Interest rate curve research | $5k

RFP 20: Optimism Starport for Compound Gateway | $100k

Developer Community Call Recap

The Compound community held a Developer Community Call last week to discuss ongoing protocol and application development. You can access an audio recording of the call here.

Markets Update

Current supply on Compound is at $17.2B from 298k unique addresses. 35% of this supply volume is ETH, 25% is DAI, and 21% is USDC. (source).

Open borrowing is at $7B from 9.2k unique addresses. 50% of this borrowing volume is DAI, 36% is USDC, and 9% is USDT. (source).

For live figures please refer to our Markets page.

Image Source: IntoTheBlock

Links & Discussions

Messari launches Messari Governor, an aggregator for users to explore, monitor, and participate in governance activity for major DeFi protocols.

Compound Labs CEO, Robert Leshner, spoke on a panel at JP Morgan’s Crypto Economy Conference.

Compound Treasury Partnership Lead, Nick Martitsch, spoke about the role of DeFi yield in traditional investment portfolios in a Coindesk webinar.

Tweet of the Week